When Emily Rodriguez checked her tax filing status for the third time in 48 hours, the screen still read “Pending.” She filed early, used a trusted electronic filing service, and even triple-checked her entries. “Why does my tax return say ‘pending’?” she asked me, exasperated. Turns out, her case wasn’t unique. Millions of taxpayers are asking the same question right now.

What does ‘pending’ mean exactly?

In IRS terms, ‘pending’ simply means your electronically filed return has been received but not yet accepted or rejected. This stage can last from a few hours to several days, depending on various processing factors. While the word itself suggests a non-event, the reasons behind it can cover a wide spectrum, from routine lags to procedural red flags.

6 possible reasons your tax return is pending

The status may be unnerving—but it’s not always bad news. I analyzed IRS documentation, spoke with independent agents, and reviewed tax software support records. Here are the six most frequent causes based on that research:

- Overwhelming return volume and systemic backlog

The IRS processes tens of millions of returns, especially between January and April. Many get stuck in automated queues. For instance, the 2025 season began with residual delays from the previous year’s backlog, ballooning pending statuses for some filers (irs.gov). - Errors or incomplete information in your submission

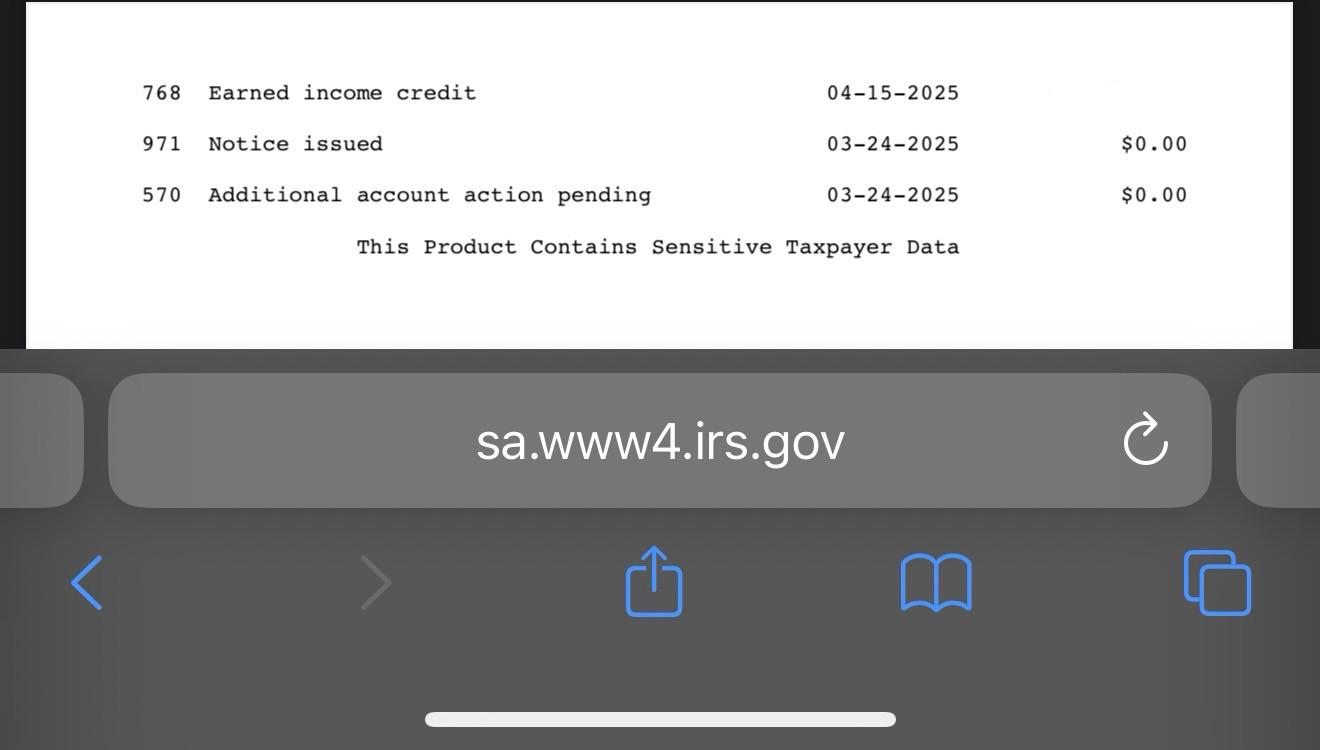

A small typo—mismatched Social Security Number, incorrect address, or an unreported income line—can trigger a stall. Tax software might not immediately detect all errors. Once in the IRS system, flawed returns need manual review, stretching out the wait. H&R Block outlines common mistakes that prompt these delays (hrblock.com). - Claims involving sensitive tax credits

Filing for the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC)? These claims are legally delayed until after mid-February to combat fraud. If you included one of these, expect longer “pending” periods while the IRS validates your claim (Taxes For Expats). - Identity verification or fraud alert

If your name, date of birth, or SSN raise fraud flags—or if the IRS finds another return submitted with the same credentials—they’ll hold your return for identity verification. This may require additional documentation, with notification coming by mail. - Technical issues in data transmission

Sometimes the problem isn’t on your side. The return might still be traveling electronically or encountering infrastructure slowdowns. TurboTax notes that e-filing systems regularly face upload congestion during high submission hours (Intuit Community). - Special processing requests, like Injured Spouse Allocations

If your return includes something unusual—say, Form 8379 for injured spouse relief—the IRS needs manual review before approval. These circumstances aren’t common, but when they apply, they almost always cause a delay (Accounting Insights).

“I didn’t even realize that claiming the Earned Income Tax Credit would delay everything,” Emily told me when we reviewed her return. “If I had known, I might’ve planned differently.”

How long is too long?

After submitting your return electronically, most people hear back within 24 to 72 hours. If it’s been over a week with no update, double-check that your return was actually submitted (look for a confirmation from your filing platform). If it’s been over 21 days, the IRS itself recommends calling them directly or checking your status with the Where’s My Refund tool.

Table: Common delays by reason

| Reason | Estimated delay | Recommended action |

|---|---|---|

| Volume backlog | 48 hours to 2 weeks | Wait; monitor status online |

| Submission error (e.g. SSN, income) | 1–6 weeks | Amend return or wait for IRS notification |

| Claiming EITC or ACTC | Hold until mid-February, then up to 3 weeks | Wait; legally required hold |

| Identity verification | 2–8 weeks | Respond promptly to mail letter |

| Transmission outage | 1–3 days | Retry or consult your tax software |

| Injured spouse claim/Form 8379 | Up to 14 weeks | Prepare for a long wait; IRS will notify |

FAQ

How can I expedite the processing of my tax return?

The quickest returns are filed electronically, with direct deposit selected. Double-check for any errors before submitting. Avoid paper filing if timing matters.

What should I do if my tax return has been pending for more than a week?

First, verify that the return was properly transmitted. Then check the IRS Where’s My Refund tool. If it’s been over 21 days since filing, call the IRS.

Are there specific errors that commonly cause tax returns to stay pending?

Yes: mismatched SSNs, inaccurate income, incorrect bank routing numbers, and even typos in names or addresses can all halt the process.

How can I check the status of my tax return online?

Use the IRS Where’s My Refund tool, or log into your filing platform (TurboTax, H&R Block, etc.) to check transmission and receive timestamps.

What steps can I take if my tax return is still pending after 21 days?

At that point, contact the IRS directly at 1-800-829-1040. You may also consider working with a tax professional to investigate irregularities or resubmit if needed.