France, known for its staunch secularism, doesn’t levy a church tax like Germany or Denmark. But that doesn’t mean churches are entirely outside the state’s fiscal radar. The reality sits somewhere between full exemption and standard tax treatment—even if on paper, many assume otherwise.

The myth of the French church tax

Many assume that like in Germany, French citizens contribute a portion of their income directly to their religious institutions through a mandatory tax. That is not the case. According to a Pew Research Center study, France has no form of church tax. Religious institutions are funded primarily through voluntary donations and, occasionally, targeted public support for heritage property.

The confusion arises often due to contrasting systems in neighboring countries. Germany, for instance, collects between 8% and 9% of income tax as Kirchensteuer, or church tax, directly passed on to religious organizations. France, meanwhile, has steered clear of this model since its landmark 1905 law on the separation of Church and State.

So, do churches in France really pay taxes?

Strictly speaking, churches in France do not pay taxes on their main sources of revenue such as donations, bequests, or subsidies. Religious groups are treated as associations under the 1901 or 1905 laws, granting them nonprofit status. As a result, they are exempt from income taxes on these revenues.

Where tax obligations can apply

That said, churches aren’t entirely free from fiscal responsibility:

- Commercial activities: If a religious group runs a bookstore, cafe, or similar enterprise, these can be taxed like any other commercial entity.

- VAT (Value Added Tax): In certain cases where services or goods are sold, churches may be liable for VAT, albeit often at reduced rates.

- Property tax: This remains a gray area. While many church buildings owned before 1905 are state or commune property—thus tax-exempt—post-1905 religious associations may be liable for local property tax, depending on use and ownership.

Voices from the parish

“People often tell me, ‘Churches don’t pay a single tax, do they?’ But when we run a Christmas market or rent out a hall, we do fill taxable forms,” explains Father Lucien Marceau of Lyon. “It’s not black and white. For the day-to-day religious work—masses, ceremonies, charity—we’re not taxed. But for anything that steps into commerce, we’re treated like any other outfit.”

Legal framework and state relations

The 1905 law is central to understanding the tax treatment of churches in France. It enshrines laïcité—secularism—as a principle, cutting off state funding for religious activities while, paradoxically, allowing some financial support for maintenance of older religious buildings under heritage protection laws.

| Country | Church Tax | Details |

|---|---|---|

| Germany | Yes | 8–9% of income tax collected for churches |

| Sweden | Yes | Mandatory religious tax administered by government |

| France | No | Churches rely on donations, are generally tax-exempt |

| Austria | Yes | About 1.1% of taxable income |

How churches stay afloat financially

Without church tax revenue, how do French congregations survive? Mainly through personal donations, bequests, fundraising events, voluntary tithing, and in specific cases, partial public subsidies for preservation.

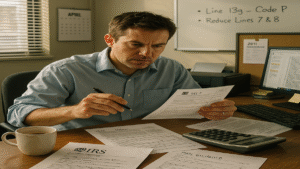

According to the Council on Foundations, nonprofit religious organizations in France qualify for VAT exemptions and allow donors to claim up to 66% of their contribution as a tax deduction, capped at 20% of their taxable income.

Comparisons spark debate

Some argue the lack of a formal church tax reduces financial stability and limits community outreach. Others view it as healthy separation, avoiding state entanglements. It remains a matter of philosophical preference—and national history.

FAQ

How do churches in France fund their activities if they don’t pay taxes?

Mainly through voluntary donations, legacies, and occasional public subsidies for heritage-preserved religious buildings. They also organize fundraising events and receive private sponsorship in some cases.

Are there any specific exemptions for churches in France?

Yes. Religious associations benefit from exemptions on income derived from donations and grants. They are also largely exempt from VAT when providing religious services and can operate under reduced tax obligations for certain types of property or restoration work.

How do church taxes impact religious attendance in other European countries?

Studies from the Pew Research Center show no significant difference in religiosity based solely on presence or absence of church taxes, although financial ties can influence individual participation choices, especially in contexts like Germany where formal registration affects tax liability.

What are the main sources of revenue for churches in France?

The most common sources are:

- Voluntary donations from individuals

- Legacies and bequests

- Ticketing or merchandising in heritage locations

- Occasional public subsidies for building maintenance

How do French churches compare to those in countries with church taxes?

French churches often operate with leaner budgets and more volunteer dependence, while their German or Swedish counterparts enjoy institutional funding via state-managed systems. Yet, French churches have more autonomy and less bureaucratic oversight due to this fiscal independence.