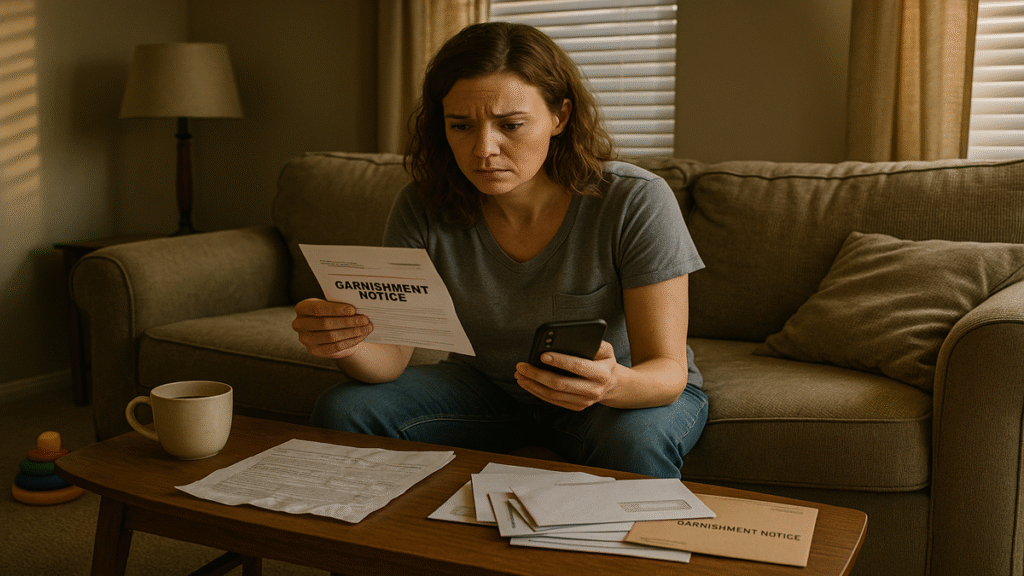

Can a court judgment take your tax refund?

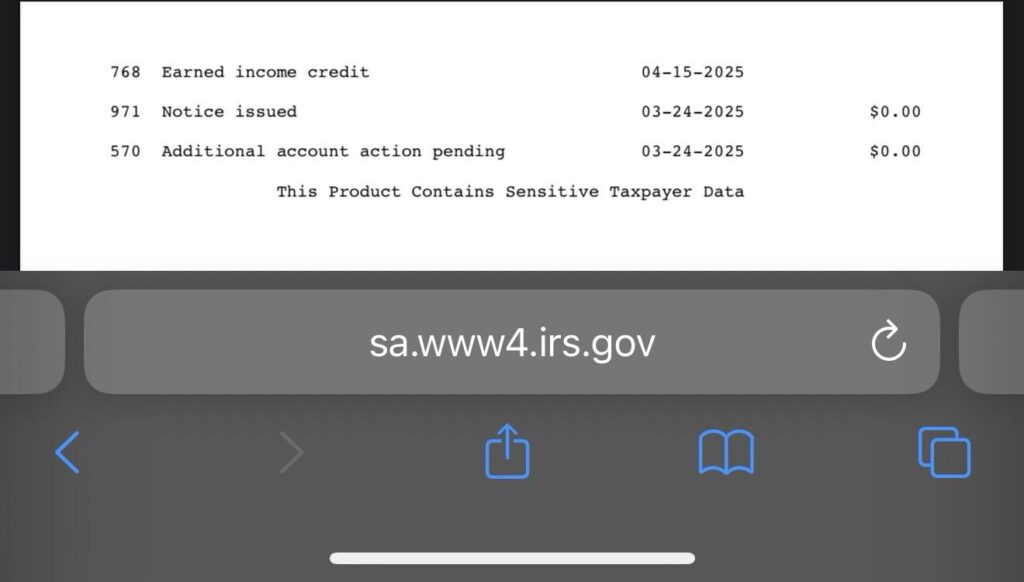

Many Americans wait eagerly for their tax refunds each year, counting on the extra cash for bills, savings, or overdue repairs. But sometimes, that refund doesn’t arrive. And a question inevitably arises: can a court judgment really take your tax refund? Understanding what a court can—and cannot—do It turns out, the answer hinges on who […]