Many Americans wait eagerly for their tax refunds each year, counting on the extra cash for bills, savings, or overdue repairs. But sometimes, that refund doesn’t arrive. And a question inevitably arises: can a court judgment really take your tax refund?

Understanding what a court can—and cannot—do

It turns out, the answer hinges on who you owe money to. Government agencies and private creditors don’t operate under the same rules. This difference matters a lot if you’re trying to hold onto your refund after a financial dispute has ended up in court.

Government debts: Direct interception, no judgment needed

If you owe money to the federal government—say, unpaid student loans, back taxes, or delinquent child support—that refund is fair game. Through the Treasury Offset Program (TOP), government agencies can intercept your tax refund automatically without ever going to court.

The TOP works like this:

- Your refund is matched against databases of unpaid debts.

- If a match is found, all or part of your refund is applied to that debt.

- The IRS sends you a notice explaining where your refund went.

This process is swift. In most cases, the money never even hits your bank account. According to Community Tax, the IRS intercepted over $5 billion in tax refund offsets last year alone.

Private creditors: It’s a different story

Private debts—credit cards, personal loans, or medical bills—require a court order to begin collection efforts. These creditors must sue you, win the case, and obtain a court judgment. But that doesn’t mean they can snatch your refund before it’s been paid.

As TurboTax explains, private creditors can’t request the IRS to garnish your tax refund directly. The IRS simply doesn’t allow it.

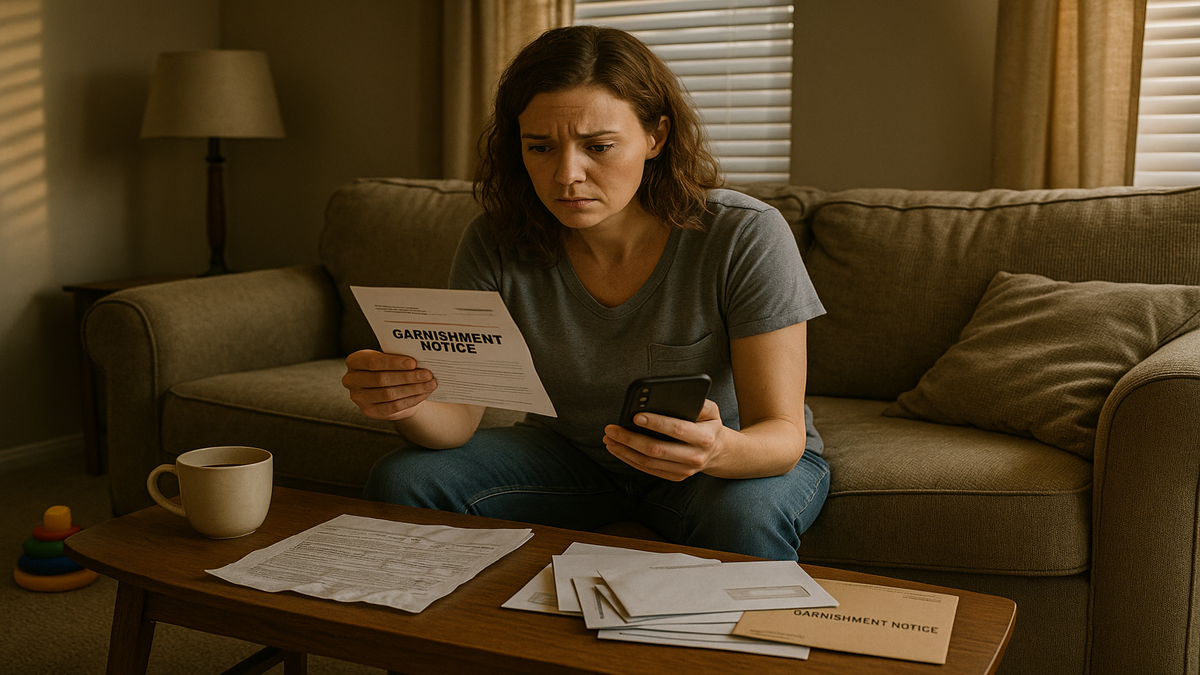

“I thought I was finally getting ahead,” said Tasha Ramirez, a retail worker in Houston. “Then two weeks after my refund hit, my account was frozen. It turns out an old credit card debt had turned into a court judgment. They cleaned out my refund money.”

Ramirez’s story isn’t uncommon. Once a refund lands in your bank account, it becomes any other asset—and then, it’s vulnerable.

How bank account garnishment works

With a judgment in hand, a creditor can petition the court for a writ of garnishment. This allows them to seize funds—often up to 25% of disposable earnings—from your bank account. This rule originates from the U.S. Department of Labor.

Once in effect, your bank may place a temporary hold on your funds, including deposited refund money. In most states, you’ll receive a notice and have a chance to contest the seizure—but that doesn’t always happen before the money is withdrawn.

| Debt type | Court judgment required? | Can it intercept refund before deposit? |

|---|---|---|

| Federal tax debt | No | Yes |

| Child support | No | Yes |

| Defaulted student loans | No | Yes |

| Credit card debt (private) | Yes | No |

State-by-state protections and exceptions

Protections vary. In Texas, for example, wages are largely shielded from garnishment due to state law (per Chance Law), but tax refunds aren’t once they’re deposited. In Michigan, legal seizure of refund-related funds can require up to 18 weeks of bureaucratic steps (Michigan Legal Help).

Spouse protections and IRS forms

If you’re filing jointly and your spouse is the one with the debt, you can file IRS Form 8379: Injured Spouse Allocation. This tells the IRS to preserve your share of the refund, even if your partner’s portion is offset.

Other options include filing motions to vacate old judgments, requesting debt relief, or negotiating terms with the creditor through legal aid clinics in your area.

FAQ

How can I protect my tax refund from garnishment?

First, understand your risk. If you only owe private creditors and there’s no court judgment, your refund is generally safe. If a judgment exists, consider cashing paper refund checks or transferring funds quickly. You can also protect part of your income by using exempt accounts in some states. Seek advice from a consumer attorney if you’re being pursued.

What steps should I take if my tax refund is garnished?

Contact the creditor and your bank immediately. Request documentation of the judgment. If the seizure is illegal or excessive, you may challenge it. Contact a legal aid office or file a motion for exemption if your funds were supposed to be protected.

Can a creditor garnish my tax refund without a court judgment?

No. Private creditors need a valid court judgment before they can carry out any garnishment. Only federal or state government agencies can intercept a refund without court involvement.

Are there any exceptions to tax refund garnishment?

Yes. Filing IRS Form 8379 can protect your portion of a joint refund. Some states also have exemptions for low-income earners or specific fund sources. Court approval may also prevent garnishment in cases of financial hardship.

How does the Treasury Offset Program work?

TOP matches tax refunds against government debt records. If you owe a federal agency, child support, or have a defaulted student loan, your refund—or a portion—can be redirected to pay off that balance. Notification is sent by mail explaining the details of the offset.